5 tech outages that prove decentralization can't wait

From AWS to CrowdStrike, major outages are increasing. Discover why centralized infrastructure keeps failing and how decentralization offers a solution.

By Joey Prebys•October 30, 2025

By Joey Prebys•October 30, 2025

What you can expect

- Why outages are happening more often

- Five recent failures that exposed our vulnerability

- Why centralization always fails

- Decentralization as a solution

Last Monday started like any other for millions of people around the world. Coffee brewing, emails queuing up, meetings on the calendar. Then, suddenly, nothing worked.

Banking apps froze mid-transaction. Coinbase locked users out of their crypto. Snapchat went silent. Zoom calls dropped. For hours, the digital infrastructure we've built our lives around simply vanished, taking with it our ability to work, communicate, trade, or even order coffee from Starbucks.

The culprit? A domain name resolution failure in Amazon Web Services' US-EAST-1 region. A single technical hiccup in one Virginia data center cascaded across the internet like dominoes, disrupting everything from Fortnite to financial services, from Ring doorbells to Robinhood trading.

But here's the uncomfortable truth that outage forced us to confront: this isn't an anomaly anymore. It's a pattern. And it's getting worse.

The acceleration: why outages are happening more often

If it feels like global tech outages are becoming more frequent, you're not imagining it. The numbers tell a stark story: nearly 30% of major outages in 2021 lasted more than 24 hours, up from just 8% in 2017. Cloud service provider outages increased 8% in the first half of 2024 versus the same period in 2023. The trend is clear and accelerating.

Three converging forces are driving this acceleration. First, AI's insatiable appetite for resources. Data center electricity consumption is projected to more than double by 2030, with AI-optimized data centers expected to quadruple their energy use. Second, exponential complexity. The average enterprise now manages over 370 SaaS applications, a dramatic increase that has created thousands of potential failure points across interconnected systems. More services mean more dependencies and more ways for things to go wrong.

Third, and most critical, is the centralization trap. AWS alone powers 30% of the global cloud market, with the top three providers controlling over 60% of all cloud infrastructure. When you concentrate this much of the world's computing infrastructure in a handful of companies, every failure becomes exponentially more damaging. It's not just about one company going down anymore. It's about the entire interconnected web of services that depend on that one company collapsing simultaneously.

The evidence: five recent failures that exposed our vulnerability

Here are five of the most severe global tech outages in history. All happened in the last five years. The concentration isn't random. The most catastrophic failures are happening now, more frequently, with greater impact, and they all share the same root vulnerability.

1. AWS outage (October 2025): the cascade effect

On October 20, 2025, the outage described in the opening triggered a cascading outage that disrupted over 1,000 businesses globally for more than 15 hours. Major services, including Snapchat, Venmo, Canva, Fortnite, Roblox, Reddit, Disney+, banking apps, and even Amazon's own Alexa, went offline.The scale wasn't accidental.

The technical issue was deceptively simple. A Domain Name System error in DynamoDB, AWS's core database service, prevented applications from finding the correct server addresses. But because of how centralized our infrastructure has become, that single bottleneck created five more failures, which created twenty-five more. One hiccup became an avalanche. Entire mornings of productivity vanished. Businesses couldn't operate. People couldn't communicate.

2. CrowdStrike/Microsoft outage (July 2024): when security becomes a liability

On July 19, 2024, what should have been a routine security update became the largest IT outage in history. A faulty update from cybersecurity firm CrowdStrike crashed approximately 8.5 million Windows devices worldwide, triggering the dreaded blue screen of death across critical systems.

Airlines, banks, hospitals, manufacturing facilities, stock markets, broadcasting services, gas stations, retail stores, and governmental emergency services went down simultaneously. Flights were grounded. Hospital systems froze, forcing appointment cancellations. Financial transactions halted.

The irony? This wasn't a cyberattack. It was the security software meant to protect against attacks that brought everything down. The worldwide financial damage was estimated at least $10 billion. For a software update that was supposed to make systems more secure.

3. Meta outage (October 2021): the social media blackout

On October 4, 2021, Facebook, Instagram, and WhatsApp went dark for approximately six hours, affecting billions of users worldwide. Not just inconvenienced. Cut off.

The outage was caused by configuration changes on the company's backbone routers during routine maintenance. Small businesses that relied on Instagram for marketing became invisible overnight. Families trying to reach each other across continents found themselves silenced. Entire communities that existed primarily on these platforms simply ceased to function.

Businesses dependent on these platforms for customer engagement saw operations grind to a halt, with many unable to respond to inquiries or take orders. Six hours. That's all it took to expose how fragile our digital social fabric has become.

4. Robinhood outage (March 2020): when you can't access your own money

In early March 2020, during some of the most volatile market conditions in history, Robinhood's trading platform suffered multiple days of outages that left millions of customers unable to trade.

The most serious outage occurred on March 2-3, 2020, when the platform shut down completely during historic market volatility. Users watched helplessly as potential profits evaporated and losses mounted, unable to execute trades during one of the largest single-day market gains in years.

FINRA ultimately fined Robinhood $70 million. Individual customers lost tens of thousands of dollars due to the platform's inability to accept or execute orders. The company that promised to "democratize finance" discovered that centralized platforms are single points of failure, even when they're marketed as liberation.

5. Rogers Communications outage (July 2022): when centralization becomes life-threatening

On July 8, 2022, Rogers Communications experienced a nationwide outage lasting approximately 26 hours that affected more than 12 million customers across Canada, disrupting mobile, home phone, internet, and, crucially, 911 emergency services.

This wasn't just an inconvenience. People facing actual emergencies, actual life-or-death situations, couldn't call for help. Interac, Canada’s major debit payment network, went offline, preventing businesses nationwide from accepting debit card transactions regardless of their internet service provider, with some stores forced to temporarily close.

The outage was caused by human error during routine maintenance. When Rogers' core network went down, even the company's own employees couldn't access systems to fix the problem. The cost? Incalculable. An entire nation's digital infrastructure was dependent on a single provider, and that provider failed when people needed it most.

The pattern: why centralization always fails

Five failures. Different companies. Different technologies. Different years. Same underlying architecture. Same devastating result.

Centralization creates an inherent structural weakness: single points of failure. When you funnel billions of users, thousands of services, and critical infrastructure through one system, that system becomes both essential and fragile. One error doesn't affect one service. It affects everything connected to it simultaneously.

AWS controls 30% of the global cloud market. Meta's platforms serve billions. Rogers was Canada's critical infrastructure backbone. When systems consolidate to this degree, failure isn't a matter of if, but when. And when it happens, there's no backup. No alternative. No way to route around the damage.

It’s also worth mentioning that these weren't cyberattacks. They were routine maintenance, configuration changes, and DNS errors. But if centralized systems are this fragile under normal operations, consider what happens when they're actually targeted. Cyberattacks are increasing in frequency and sophistication, and our consolidated infrastructure makes every attack exponentially more devastating. The most dangerous vulnerabilities aren't just the routine failures we've built our economy on. It's that we've created perfect targets.

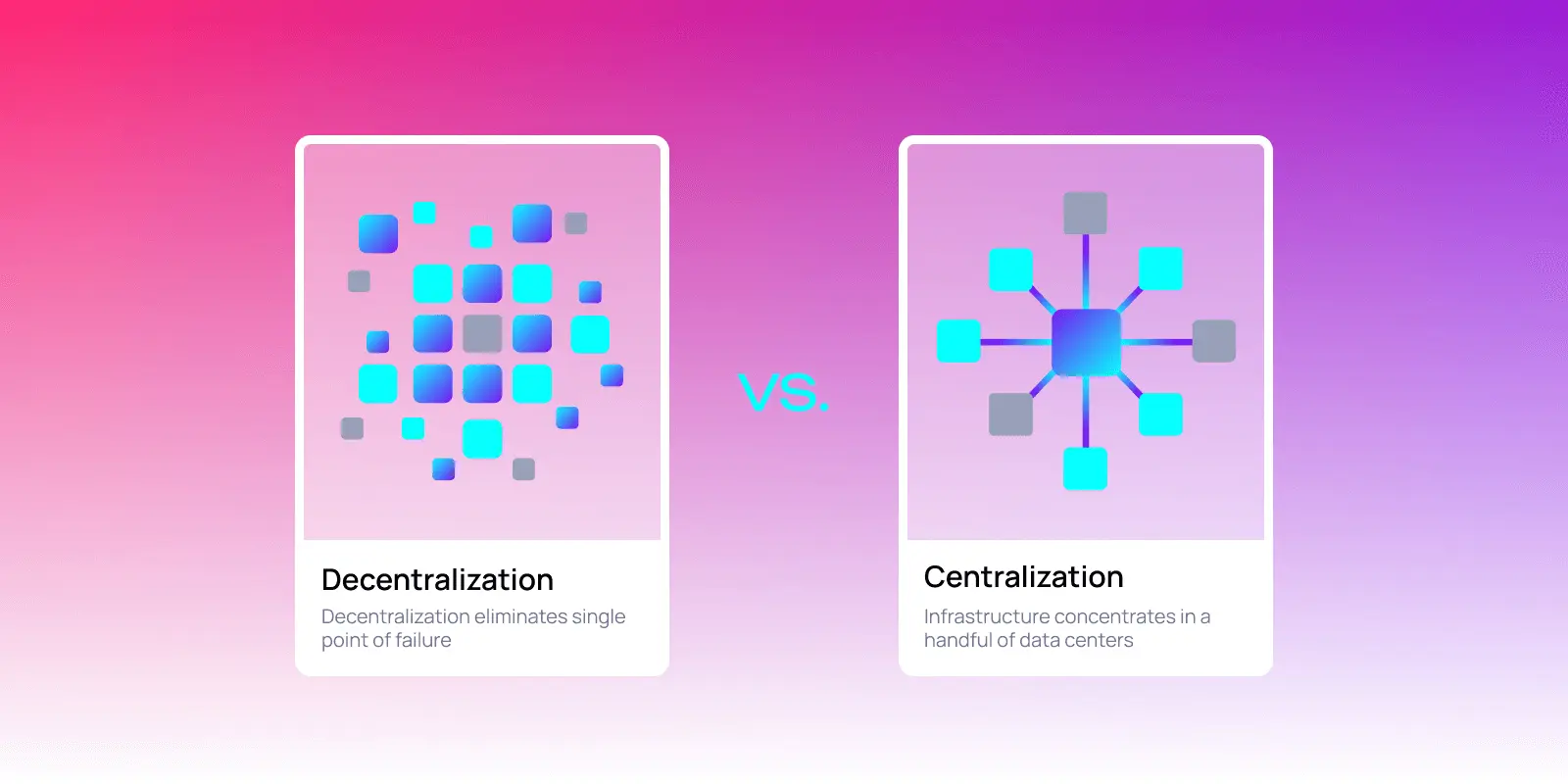

The solution: decentralization isn't optional anymore

Decentralization distributes infrastructure across thousands of independent nodes instead of concentrating it in a handful of data centers. When one node fails, the system routes around it. When a hundred fail, users don't notice. No single point of failure means no cascade.

DePIN

Decentralized Physical Infrastructure Networks (DePIN) rethink how infrastructure operates. Projects like Filecoin store data across many devices with multiple copies. Acurast transforms unused smartphones into decentralized compute providers. NeuroWeb builds decentralized knowledge graphs. Distributed across thousands of contributors, the vulnerabilities that brought down CrowdStrike and Rogers simply don't exist.

DeFi

Decentralized Finance (DeFi) and decentralized exchanges (DEXs) address the Robinhood problem directly. Instead of relying on a single platform that can lock you out of your own money, DEXs operate on blockchain networks with no central point of control. Your assets remain accessible even if individual interfaces go down, because the underlying infrastructure is distributed across thousands of nodes.

Decentralized AI

Decentralized AI distributes model training and inference across networks rather than concentrating it in massive data centers. When AI decision-making is decentralized, no single outage can halt the critical systems that depend on it for healthcare, logistics, or financial transactions.

Polkadot: connecting it all

Polkadot ties it together with forkless upgrades that avoid downtime and native interoperability for trustless data exchange across networks, backed by over 825 million in staked DOT and over 600 validators. When decentralized networks connect through decentralized platforms secured by decentralized validators, you create redundancy at every layer.

This isn't theoretical infrastructure for the future. It's the alternative we need right now. Not a single replacement for AWS, but thousands of smaller networks, collectively owned, locally operated, globally connected. Infrastructure that can't be taken down because there's no center to strike.

We can't afford to wait

AI's explosive growth isn't reducing these failures. It's guaranteeing more of them. As AI systems take on critical decision-making across healthcare, logistics, finance, and emergency response, every outage becomes exponentially more dangerous.

Last week’s AWS outage. July 2024's CrowdStrike disaster. October 2021's Meta blackout. March 2020's Robinhood collapse. July 2022's Rogers emergency services failure. These aren't flukes. They're symptoms of architectural decisions we keep doubling down on.

The solution exists. DePIN networks distribute infrastructure across thousands of contributors. Decentralized AI eliminates bottlenecks. Polkadot provides the platform for building resilient, interoperable systems with shared security.

The choice is stark: continue building on a fragile centralized foundation that fails more often and costs more each time, or build redundancy now. Before the next outage isn't just expensive. Before the next outage crosses the line from expensive disruption to human catastrophe

Ready to build on resilient infrastructure? Start exploring Polkadot's ecosystem and join developers creating the decentralized future.