How the Polkadot community enabled our multi-chain breakthrough

From treasury proposal to multi-chain reality: How Polkadot's governance and community support enabled Bifrost's breakthrough in bringing liquid staking across major DeFi networks.

By Lurpis•September 22, 2025

By Lurpis•September 22, 2025

When we first proposed borrowing 1 million DOT from the Polkadot treasury, we knew we were asking for more than just funding. We were asking the community to trust us with their collective resources.

That trust paid off. Today, vDOT operates across Ethereum, Arbitrum, Base, and BNB Chain, with over 21 million DOT minted. But this success story isn't really about Bifrost's technical achievements.

It's about what happens when a community genuinely supports innovation.

Here's how Polkadot's governance and collaborative ecosystem enabled our biggest breakthrough yet.

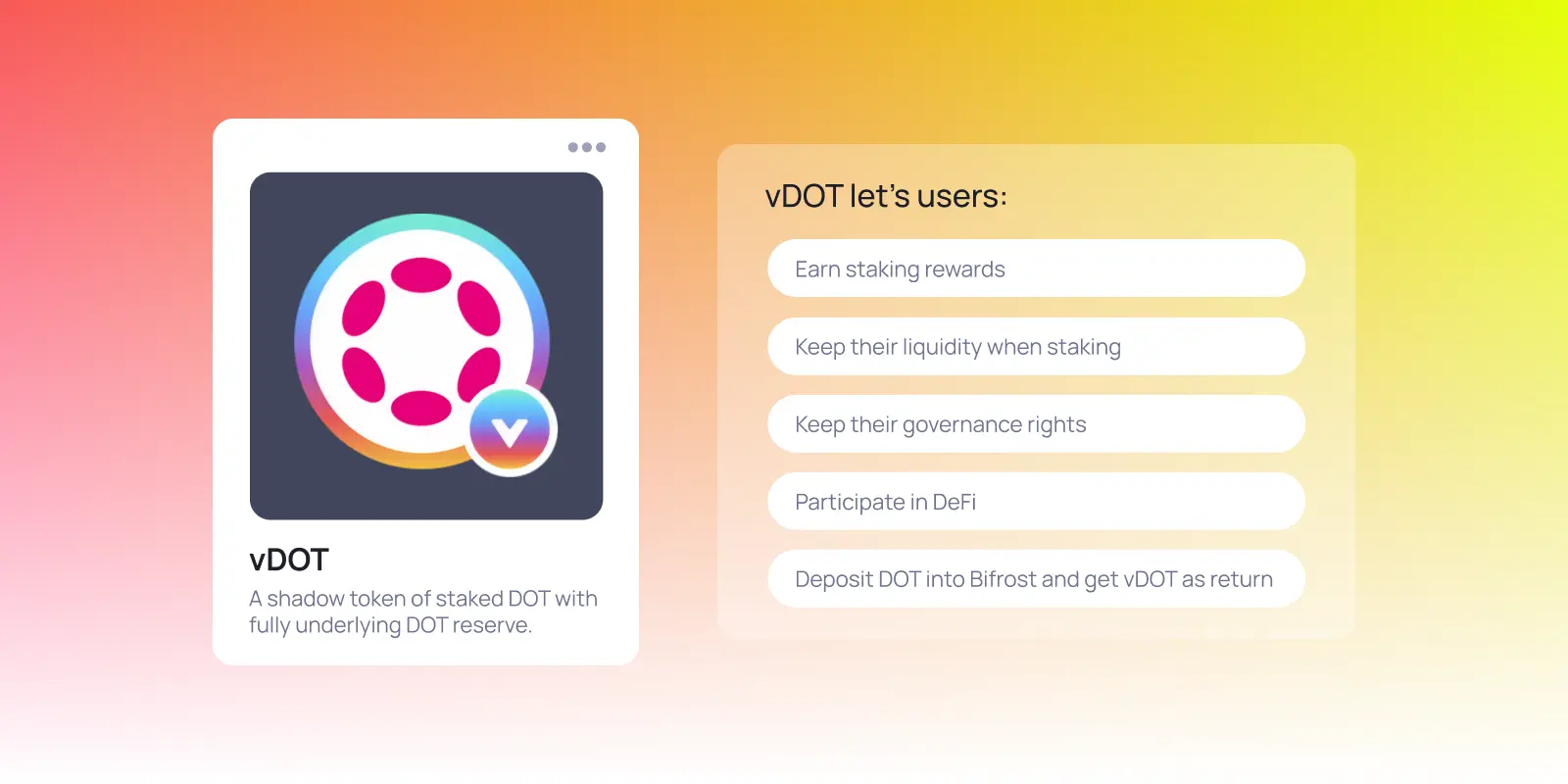

What Bifrost brings to Polkadot

Bifrost is a staking yield layer designed to deliver composable, crypto-native staking yields for stablecoins, RWAs, and DeFi. In other words, we let users earn staking rewards while keeping their tokens liquid and usable across different DeFi applications. In Polkadot, high staking rates keep the network secure, but leave a large share of DOT locked in native staking. This creates a challenge: strong network security, but limited capital efficiency across broader DeFi. vDOT was introduced to address this: it lets users retain staking yield, liquidity, and governance rights simultaneously. Users no longer need to choose between earning rewards and participating in DeFi.

Each governance proposal we submit comes with auditable goals and a clear implementation path. Treasury #613 demonstrates this in action: our DOT liquidity loan injected nearly $10 million into Polkadot DeFi and generated 42,723 DOT in interest for the treasury. This demonstrates that public governance resources and market execution can form a closed loop: capital bootstraps liquidity, and liquidity returns value to the ecosystem and the treasury.

Working with Hyperbridge

While Polkadot provides a mature cross-chain foundation, DOT liquidity has largely remained within the ecosystem, making it difficult to reach users and applications on mainstream EVM networks. We needed a cross-chain path that is secure, verifiable, and easy to use. Hyperbridge’s decentralized, trustless design meets these requirements and offers a developer- and user-friendly experience, allowing vDOT’s combination of staking yield, liquidity, and governance accessibility to reach a wider audience.

Bifrost was the first project to integrate Hyperbridge. After several months of development and multiple rounds of internal testing, we enabled cross-chain transfers of DOT and vDOT between the Bifrost-Polkadot chain and Ethereum, Arbitrum, Base, and BNB Chain. With the technical path in place, the next step was market adoption, so we jointly introduced the DeFi Singularity proposal with Hyperbridge—a campaign to bootstrap liquidity and adoption across these networks.

DAO journey: From the loan to DeFi Singularity

During the earlier DOT loan proposal (#613), we used open discussion and on-chain disclosures to explain, line by line, how funds would be used, what the risk boundaries were, and how ecosystem expansion would proceed. This established the procedural and trust foundation for Referenda #1439, our DeFi Singularity proposal. The referendum focused on a single clear goal: enabling sustainable liquidity and real usage for DOT/vDOT across major multi-chain networks, with an execution plan that is transparent and auditable.

Once live, users could bridge DOT or vDOT via Hyperbridge to the target network, provide liquidity in designated pools (e.g., vDOT/ETH), and claim rewards denominated in vDOT on a periodic basis. Before this, EVM-side users could not conveniently access DOT/vDOT. With bridging and incentives in place, external capital was attracted to seed depth; once sufficient liquidity formed, EVM users could simply use ETH to acquire DOT/vDOT, further lowering the barrier to entry.

The results have been significant. So far in the campaign, DeFi Singularity has attracted over $4 million in total value locked, vDOT’s cumulative mint has surpassed 20 million DOT, and some pools have delivered ~80% APY during the incentive period (depending on the phase and pool).

More important than the headline numbers is the structural shift: capital moved from single-chain, static staking to multi-chain participation; new users have been onboarded through EVM entry points; and DOT ownership and usage broadened beyond the Polkadot ecosystem. In parallel, more DeFi protocols integrated vDOT for its composability. Users arrived for yield and stayed for governance and ecosystem assets—creating a virtuous cycle of external acquisition and internal retention.

Looking ahead: A replicable model for community-led innovation

This experience shows that when community governance, ecosystem partners, and treasury funding work together, the results are significantly more effective. In practice, this means three key principles: First, involving governance early helps surface and resolve issues at the design stage. Second, partner selection should prioritize security and composability to support continuous integration and long-term expansion. Finally, treasury capital provides the initial spark, but sustainable mechanism design determines durability, favoring public-goods pathways that are reusable, auditable, and capable of positive spillovers.

This has been an engineering-driven effort led by the Polkadot community: from proposal, discussion, and voting to execution—every step is traceable and verifiable. We will continue to follow a community-first approach, expanding vDOT liquidity and use cases across more networks while keeping the loop intact—yields generated on multi-chain, governance consolidated on Polkadot.

We hope more teams adopt a similar methodology—using governance as a tool for execution rather than just discussion, and building products that bring in new users while strengthening the overall ecosystem.

Ready to be part of what we built together? The DeFi Singularity campaign is live and thriving—join thousands of community members helping expand Polkadot's presence across major DeFi ecosystems. Learn more and get started here.

Lurpis is the Co-Founder of Bifrost.