CBDCs vs. Stablecoin: Competing visions for digital currency

Two forms of digital money, two opposing visions for finance. From centralized control to decentralized participation, explore how CBDCs and stablecoins differ and how Polkadot supports a decentralized financial future shaped by community governance and open access.

By Joey Prebys•April 14, 2025

By Joey Prebys•April 14, 2025

What you can expect

- A breakdown of what CBDCs are, how they work, and why governments are pursuing them

- A look at how stablecoins operate, including real-world use cases around the globe

- A side-by-side comparison of CBDCs and stablecoins

- A perspective on how Polkadot supports open, decentralized finance

The future of money is being reshaped in real time. Around the world, governments are testing central bank digital currencies (CBDCs) as a way to modernize payments and assert control in a digital economy. At the same time, stablecoins, crypto-native digital assets designed to maintain stable value, are gaining momentum as tools for open, decentralized finance. These two models represent fundamentally different visions: one driven by centralized authority, the other by accessibility and user empowerment. In the United States, the divide has become especially stark, with President Trump recently banning the development of a CBDC altogether.

While CBDCs and stablecoins are both forms of digital money, they are built on very different foundations. One reflects traditional power structures. The other reflects the values of decentralization and open access. This post explores how each is being used around the world, the values they represent, and what’s at stake as governments and communities chart different paths forward.

What is a CBDC, and how does it differ from crypto?

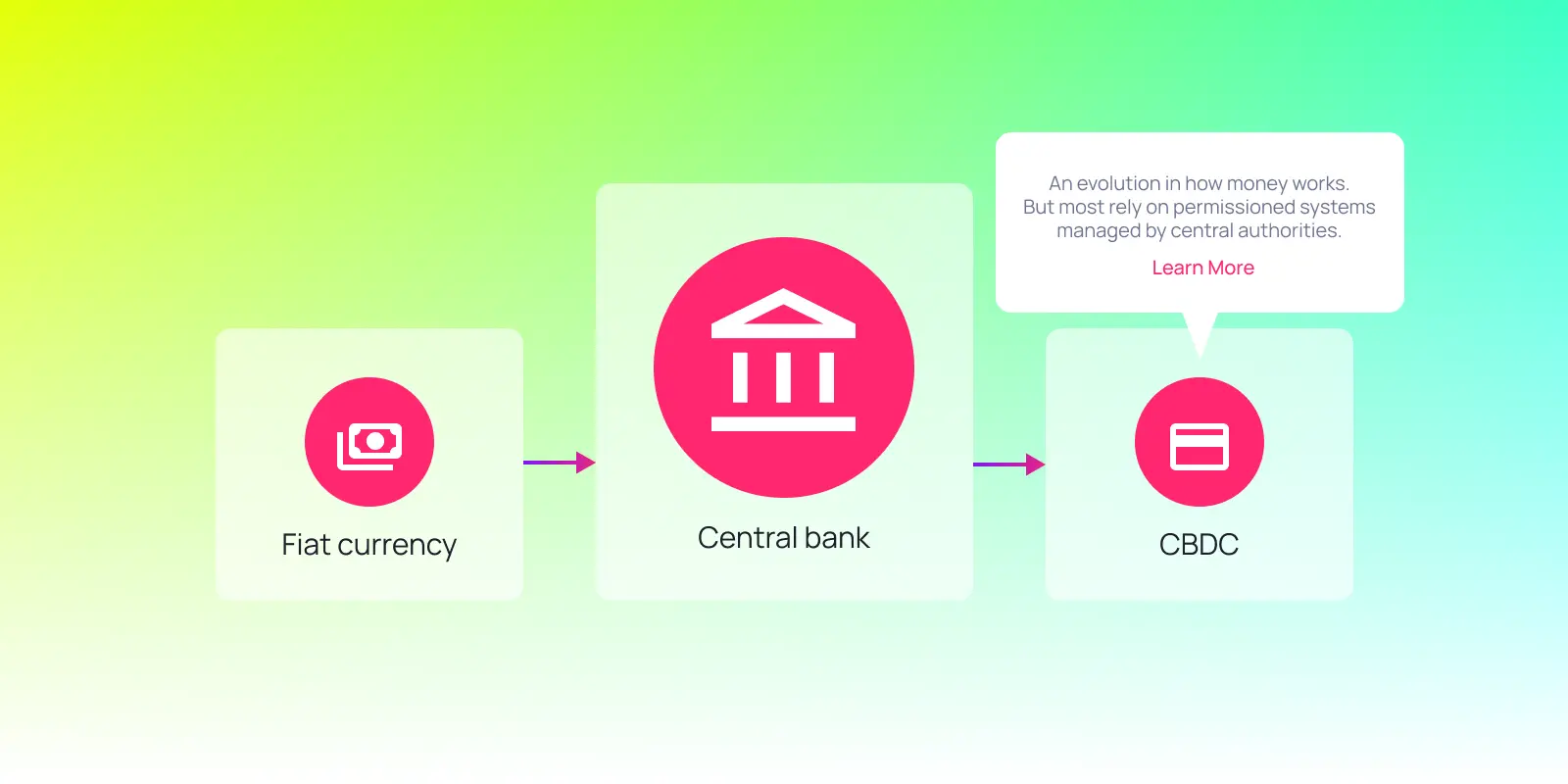

A central bank digital currency (CBDC) is a digital form of a country’s fiat currency issued and controlled by the government. With so much of life happening online, governments are looking for new ways to update how money works and keep up with changing expectations around payments and access. CBDCs are part of that shift.

Cryptocurrencies are decentralized and independent of nation states, while CBDCs are issued by central banks and tied directly to national monetary policy. They’re meant to hold a stable value, unlike crypto, which can be highly volatile.

CBDCs are often described as the next step in the evolution of money. From barter to gold to paper cash to digital wallets, digital currencies issued directly by central banks represent one way governments are reimagining how value moves in the digital economy, with programmability and control built in from the start. Some CBDCs experiment with distributed ledger technologies or blockchain-inspired infrastructure, but most rely on permissioned systems that can be managed by central authorities rather than on decentralized, community-governed protocols.

Why governments are exploring CBDCs

Supporters say CBDCs could improve payment efficiency, cut transaction costs, and promote financial inclusion. Emerging markets are especially interested. According to the IMF, about 60% of central banks in low- and middle-income countries cite financial inclusion as one of their top reasons for pursuing them.

As cash becomes less viable in an increasingly digital world, CBDCs could offer a bridge for unbanked communities to access digital financial services. In theory, they could help people participate in the formal economy.

But theory isn’t reality—yet. Most countries remain in pilot phases. Whether CBDCs actually close inclusion gaps or reinforce existing power structures depends entirely on how they’re designed and governed.

Where CBDCs fall short

CBDCs are not decentralized. They run through a central authority and are programmable, meaning governments are capable of enforcing strict parameters on how they are used. They could impose spending limits or even blacklist certain transactions. CBDC critics warn of too much surveillance and overreach, especially in countries that don’t have strong privacy protections. Whether CBDCs expand access or restrict freedom will depend entirely on how they’re built—and who controls them.

CBDCs also face technical hurdles. They require solid infrastructure, strong cybersecurity, and people who know how to use the technology. In places with limited internet access, fewer smartphones, or low digital literacy, adoption is likely to be slow. And while crypto has its own set of risks, CBDCs introduce a different one. If the central system fails or is compromised, everything could come to a halt. That’s not the case with decentralized networks, which are designed to stay functional even if parts of them are attacked.

CBDCs around the world

CBDCs are not a theoretical concept, they’re here. Over 130 countries are exploring, piloting, or launching CBDCs. Some are looking to build more independence in global finance, others are more focused on faster, more inclusive payments.

- China: The Digital Yuan (e-CNY) is one of the most advanced CBDCs. It’s considered legal tender in China and has been integrated into public transportation systems across several major cities. As of mid-2024, around 180 million wallets had been created, meaning about 12.76% of the population had been onboarded. Adoption is still limited, but the PBoC is pushing hard, especially as a counter to decentralized alternatives like Bitcoin.

- India: The Reserve Bank of India launched the Digital Rupee (e₹) in 2022 to modernize the payment ecosystem and reduce reliance on physical cash, which is costly to maintain. The rollout has been cautious, with pilots still underway as of 2024. India sees the e₹ as a way to improve settlement systems and maintain control in a world of growing crypto adoption.

- United Arab Emirates: The UAE introduced its Digital Dirham strategy in 2023, with a full launch planned by 2026. So far, the UAE Central Bank has completed successful pilot tests, including one that processed over $22 million in real-value transactions. The goal is to support financial inclusion and strengthen the country’s position as a digital finance hub.

Will the United States ever adopt a CBDC?

Shortly after taking office in January 2025, President Donald Trump signed an executive order banning federal agencies from creating, issuing, or promoting a central bank digital currency. But this does not mean the U.S. is turning away from digital currency altogether. The move signals a policy shift toward decentralized assets like Bitcoin and away from government-controlled alternatives. The rejection of a U.S. CBDC is less about technology and more about power: Who should control money in a digital economy?

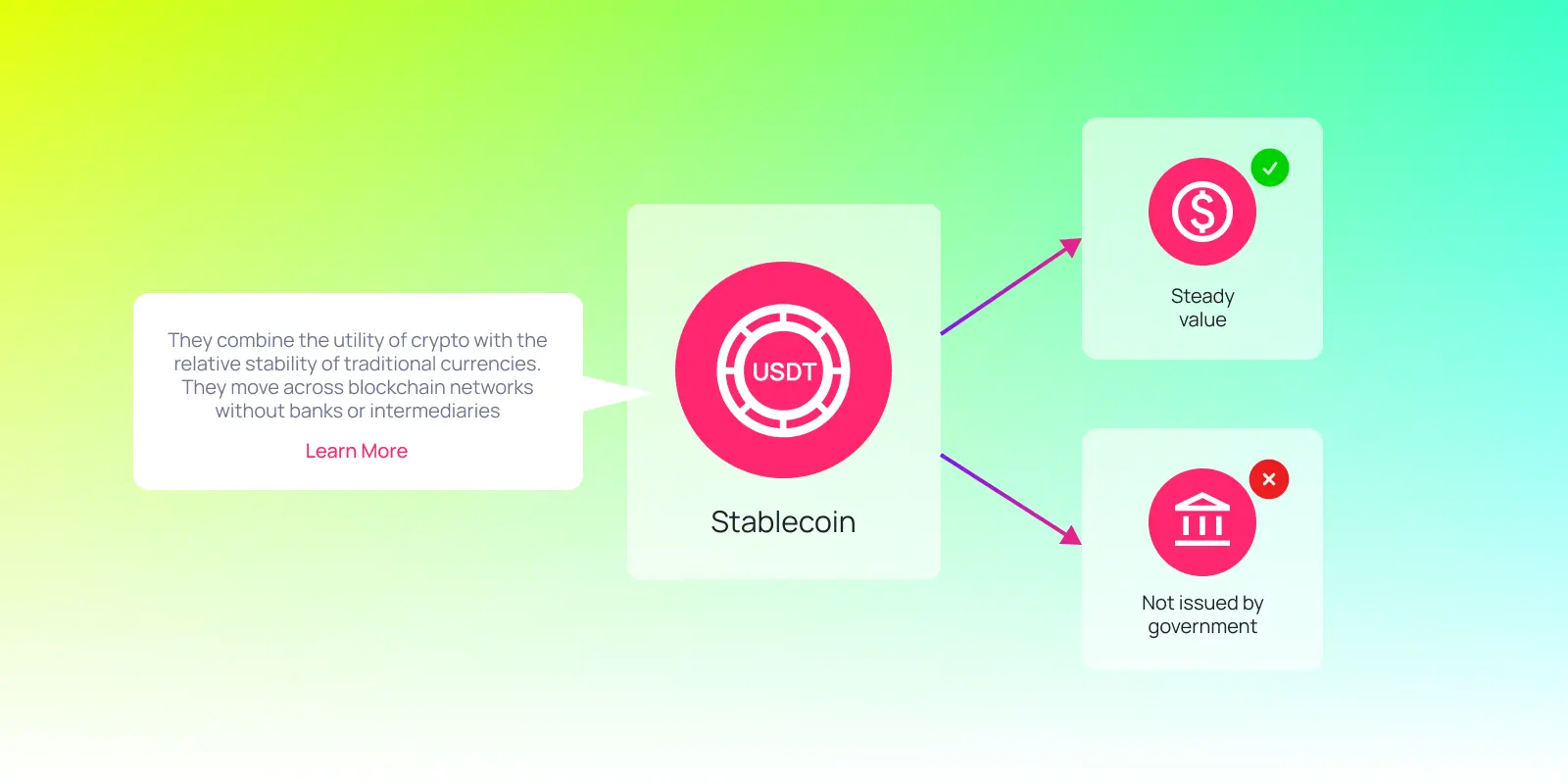

What is a stablecoin?

Stablecoins are digital assets designed to maintain a steady value, usually by being pegged to a fiat currency like the U.S. dollar. Unlike CBDCs, they aren’t issued by governments. Instead, they’re created by private companies or decentralized protocols, and anyone with a crypto wallet can use them; no bank account or permission is required. Some stablecoins are backed 1:1 by fiat reserves, like USDC and EURC; others are backed by crypto collateral, like DAI; some are even backed by physical assets like gold, such as PAX Gold (PAXG); and a few use hybrid algorithmic models, like Frax.

People use stablecoins for a range of everyday transactions. They’re especially useful for cross-border payments, whether someone is sending money to family abroad or covering a shared expense with a friend in another country. They combine the utility of crypto with the relative stability of traditional currencies, which makes them especially useful in places where access to financial services is limited or local currencies are unstable. Because they move across blockchain networks without banks or intermediaries, they offer a faster and more affordable alternative to traditional international money transfers or remittances.

That said, they’re not risk-free. Their value depends on reserves, and not every issuer is transparent about what’s backing them. Most stablecoins are tied to the U.S. dollar, so if the dollar weakens, that impact carries over. There’s also the risk of stablecoins depegging during volatile markets and growing uncertainty around how stablecoins will be regulated going forward.

Stablecoins: a lifeline in volatile economies

Stablecoins are powerful tools for financial inclusion and inflation hedging in places with volatile currencies. Their real-world utility has helped drive crypto adoption in regions like Sub-Saharan Africa and Latin America, which led the world in 2023 with year-over-year growth rates above 40%, according to Chainalysis. In countries like Argentina, Nigeria, and Ethiopia, where inflation and currency devaluation have been persistent challenges, people turn to dollar-pegged stablecoins like USDT and USDC as a safe store of value. In Venezuela, stablecoins have become a primary medium of exchange in place of the hyperinflated local currency.

While the dollar is often viewed as a global safe haven, anchoring financial access to a single currency introduces its own risks. In regions already vulnerable to external economic shifts, this kind of dependency can limit financial autonomy and resilience. The appeal of stablecoins lies in their ability to offer more stability than volatile local currencies, but their long-term sustainability depends on the strength and policies of the system they are built on.

CBDCs vs. stablecoins: A philosophical fork in the road

CBDCs and stablecoins may both be tied to fiat currency, but they operate on very different principles. CBDCs are an extension of state authority, an evolution of existing monetary systems to the digital economy designed to give governments more direct tools for policy execution. Stablecoins, on the other hand, represent a break from it: they were born out of the crypto movement and carry its ethos of accessibility, interoperability, and financial autonomy.

These are not interchangeable tools. CBDCs are built for top-down control, while stablecoins lean toward bottom-up access. They could technically coexist, but they serve different interests, answer to different stakeholders, and reflect different philosophies about how money should move in a digital world.

Polkadot: A platform for open, decentralized finance

If stablecoins carry the ethos of crypto—accessibility, interoperability, and financial autonomy—Polkadot is one of the ecosystems turning decentralization ethos into real infrastructure. Its modular architecture gives developers the tools to build financial systems that are open by design and not limited by centralized control.

USDC is available natively on Polkadot and plays a growing role across the network. It is the default currency on Centrifuge, a platform focused on bringing real-world assets onchain in a way that increases transparency, broadens access to financing, and reduces reliance on traditional gatekeepers. Both USDC and USDT are also supported by Hydration, a decentralized exchange (DEX) where users can easily swap stablecoins and tap into a broader ecosystem of assets without the need for intermediaries and outside the control of centralized institutions.

Governance on Polkadot happens fully onchain and is led by its global community. In a world where digital currency could take many forms, Polkadot supports a version that stays true to the values of decentralization and user empowerment.

The future of digital money

CBDCs and stablecoins are shaping the future of money in real time. They may both be digital and tied to fiat, but they're not the same—and they don't serve the same future. CBDCs are about control and policy execution. Stablecoins are built for access, flexibility, and open participation.

Neither is perfect. Stablecoins raise questions about reserves and regulation. CBDCs raise concerns about privacy, surveillance, and centralized power.

True to its Web3 philosophy, Polkadot supports a version of digital currency infrastructure that is open, interoperable, and governed by the community.

Learn more about how Polkadot is laying the foundation for future-ready, cross-border finance.