DeFAI: Could AI agents be the missing piece for DeFi adoption?

AI agents could make DeFi feel intuitive instead of overwhelming. Built on Polkadot, DeFAI aims to simplify participation and expand access for all users.

What you can expect

- Why DeFi is still hard for most people to use

- How DeFAI can simplify participation and reduce complexity

- How agentic AI improves DeFi UX through intent-driven design

- Real-world examples of user-first DeFAI in motion

- How AI agents could expand access to DeFi

- The future of DeFAI and how it can build systems that empower rather than control

If DeFi was meant to revolutionize finance, why does it still feel out of reach for most people? Wallet counts and TVL charts keep climbing, but for many, decentralized finance remains a confusing experiment built by and for insiders. Is this what meaningful adoption looks like?

True adoption goes beyond charts and statistics. It's about usability, trust, and the ability for anyone, regardless of background or technical skill, to access financial tools that actually serve them. If DeFi is going to fulfill that promise, something has to change.

In our first article on DeFAI, we explored what decentralized AI agents are and how they work. Now we’re asking something bigger: could they help unlock a whole new level of adoption, where DeFi finally delivers on its ultimate promise?

In this article, we’ll explore how decentralized AI could help DeFi overcome its biggest barriers, from complex UX to limited inclusivity, and why Polkadot’s modular design makes it a powerful foundation for this shift toward more human-centered infrastructure.

Why DeFi is still hard for most people to use

Before we get into how AI might unlock a new era for DeFi, we need to be honest about where things stand today. Despite years of growth, DeFi is still too complex even for some crypto-natives—let alone mainstream users. Jargon, risk, and cognitive overload keep most people on the sidelines.

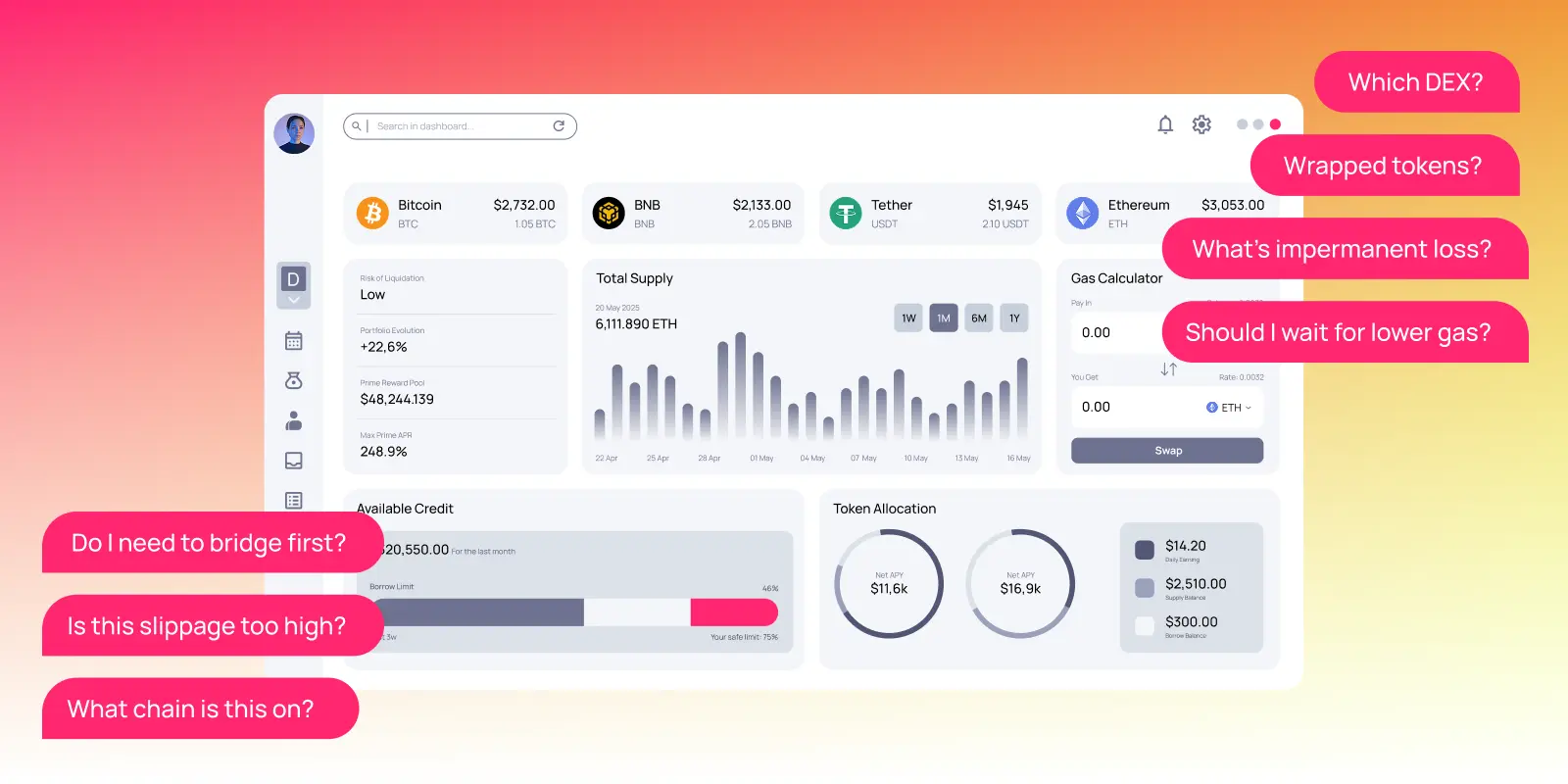

From setting up wallets and navigating bridging flows to comparing protocols and understanding concepts like impermanent loss, the learning curve is steep. Users often need to know whether their tokens are on the right chain, if they’re wrapped, which DEX to use, how to evaluate APYs, and whether the returns justify the gas. Participation demands not just technical literacy, but constant attention and context switching—traits that most average users simply don’t have time for.

That’s a user experience problem, not a user problem. And it’s one of the biggest reasons adoption still lags behind potential.

How DeFAI can simplify participation

DeFAI offers a way forward. By pairing crypto automation with intelligent infrastructure, decentralized AI agents can help make DeFi usable, not just possible, for everyday participants. These agents can scan for opportunities, rebalance portfolios, and optimize yield strategies across protocols, all while minimizing the manual overhead that currently holds users back.

A DeFi agent can recognize when a better reward pool becomes available and move funds automatically, compounding your earnings without requiring you to chase APY dashboards. It can also identify a risky position and adjust your exposure before things go south.

This shift isn’t about giving up control. It’s about choosing peace of mind over micromanagement. Instead of manually toggling between interfaces or re-reading liquidity guides, you could select an agent aligned with your risk tolerance and financial goals.

Over time, the ability to customize an AI agent for your DeFi strategy could unlock a smoother, safer, and more intuitive entry point into decentralized finance, especially for those who have been left out until now.

How Agentic AI improves DeFi UX (not just automates tasks)

Bots have been used in DeFi for years, but until now, they’ve mostly been built to extract value, not extend access. They scan for arbitrage, chase rewards, and execute predefined scripts. Useful? Yes. Transformative for everyday users? Not really. They weren’t designed to solve the UX problem.

Agentic DeFi is a shift from system-level efficiency to an intent-driven design, a UX model where users define outcomes, and agents handle the complexity behind the scenes. These agents don’t just automate actions. They rethink participation.

Today, using DeFi often means bridging assets across chains, checking whether tokens are wrapped, comparing APYs, and jumping between dashboards just to execute a single decision. DeFAI agents reduce that complexity by managing those tasks in the background, making participation feel seamless without removing user choice.

Imagine an intent-driven system where you tell your agent, “I want steady yield with low risk,” and it selects and manages a strategy across multiple protocols, no toggling, no homework. Imagine having a personalized dashboard that reflects your goals instead of raw protocol data. DeFi, without the puzzles. Just usable tools that work.

When built in an open, modular infrastructure like Polkadot, DeFAI agents are inherently composable and interoperable. This enables smarter defaults, fewer steps, and a more confident path to participation. AI agents won’t solve crypto’s UX problem alone, but they shift usability from an afterthought to a system-level feature. By aligning with user intent and abstracting complexity without obscuring control, agentic AI offers a scalable, human-centered way to make DeFi more intuitive and accessible.

Real-world examples of user-first DeFAI in motion

On Polkadot, projects like Phala Network and NeuroWeb (formerly OriginTrail) are moving DeFAI forward in practical, user-first ways:

- Phala Network enables confidential, autonomous agents using trusted execution environments (TEEs). These agents can handle sensitive tasks privately while still producing verifiable results, balancing privacy and transparency.

- NeuroWeb provides structured, linked, and tamper-proof data through a decentralized knowledge graph. This gives AI agents the context they need to reason effectively and make better decisions.

These tools aren’t siloed. They are modular, composable, and already addressing key challenges around privacy, data quality, and usability. And because they are built on Polkadot, they operate in an ecosystem where interoperability is the starting point.

Together, they show that DeFAI isn’t a distant promise. It’s already reshaping what finance can look and feel like when it’s designed for people instead of just protocols.

How AI agents could expand DeFi’s accessibility

DeFi today is for the few. Even with improved tooling, it still caters mostly to insiders with the time, technical literacy, and risk appetite to navigate it.

DeFAI has the potential to change that. By acting as a personalized financial agent, it can make DeFi feel intuitive, like a financial assistant, instead of something you have to decode. Instead of forcing users to adapt to DeFi, DeFAI adapts DeFi to them.

For ecosystems like Polkadot, this isn’t just about improving DeFi UX; it’s about aligning infrastructure with values. Open access. Community-led governance. The ability to delegate without giving up control. DeFAI reflects those principles in action, making it easier for people to participate on their own terms.

And unlike traditional finance, where intelligent tools are often gated behind institutions, DeFAI is being built from open-source foundations. That means the benefits of automation don’t have to stay exclusive. They can extend to anyone with a wallet and a goal.

That’s a radically different vision of inclusion—one that only Web3 can realistically deliver.

The future of DeFAI: building systems that empower, not control

AI in finance isn’t neutral. It can either deepen centralization or drive decentralization forward. In DeFi, the difference lies in how we design it.

DeFAI creates a space where users are informed, agents are aligned with their goals, and systems remain transparent by default. Instead of hiding decisions behind black boxes, we can design automation that makes intent visible and invites input.

Polkadot’s open governance and modular infrastructure support this shift. With onchain governance through OpenGov, the community (not a central entity) can help decide how AI agents are built, funded, and managed across the network. That means DeFAI can grow without losing sight of its purpose: giving people more control over their financial lives, not less.

Want to explore how Polkadot supports decentralized AI in DeFi and beyond? Discover Polkadot's AI use cases to see how builders are unlocking a smarter, more autonomous web.