How to stake DOT on Polkadot (without breaking a sweat)

A step-by-step guide to staking DOT on Polkadot. Learn how to stake from your wallet or with the Polkadot Staking Dashboard—and start earning rewards securely.

What you can expect

- What does it mean to stake DOT?

- Which staking options can you choose from?

- How do you stake directly from your wallet?

- How do you stake using the Polkadot Staking Dashboard?

- Dashboard or in-wallet staking: which is right for you?

- What should you know before staking your first DOT?

Put your DOT to work. Staking lets you earn rewards, protect the network, and keep full control of your assets—all while shaping Polkadot’s future. With multiple ways to stake, you can choose the method that fits your balance, time, and experience level.

Polkadot gives you two main ways to get started:

- In-wallet staking: a more streamlined experience through wallets like SubWallet, Talisman, or Nova Wallet.

- The Polkadot Staking Dashboard: a browser-based hub with powerful features for managing your stake.

This guide walks you through both step by step so you can start staking with confidence.

What is staking DOT?

Staking is how proof of stake networks like Polkadot stay secure and decentralized. When you stake DOT, you lock up your tokens to support the network’s validators—the participants who confirm transactions and add new blocks to the blockchain. In return, you can earn staking rewards paid in DOT.

Did you know? Polkadot uses a Nominated Proof of Stake (NPoS) consensus mechanism. That means nominators back trustworthy validators with their DOT, and both share in the rewards. This design helps balance decentralization, security, and fairness.

Polkadot staking is more than just a way to grow your holdings. By choosing trustworthy validators, you help protect the network against attacks and keep it running smoothly. Importantly, staking DOT does not impact your ability to participate in the network’s governance. You can still use your DOT to vote on proposals, influence technical upgrades, and shape the policies that guide Polkadot’s future.

Whether you are just learning how to stake DOT or looking to fine-tune your current approach, staking is one of the most direct ways to contribute to the network while earning potential rewards.

Your staking options

Polkadot offers two main ways to stake DOT, depending on how much control or simplicity you prefer. For this guide, we’ll focus on the two easiest and most secure options: staking through the Polkadot Staking Dashboard or staking directly in a supported wallet. Both keep you in control of your DOT, maintain your governance rights, and support the health and decentralization of the network.

Polkadot Staking Dashboard

The Polkadot Staking Dashboard is a browser-based hub that works with wallets like Talisman, SubWallet, and Nova Wallet. It gives you full control over your stake, including advanced settings, validator selection, and onchain actions. This method is trustless and decentralized, meaning you keep full control of your DOT and maintain your governance rights. It’s a great choice for users who want to maximize network security and have the flexibility to choose between nomination pools (lower DOT requirement, simpler setup) or solo staking (higher DOT requirement, more control). The trade-off is that it may feel more complex for beginners compared to one-click exchange staking.

Native staking in your wallet

Some wallets let you stake DOT directly within their interface without opening the Staking Dashboard. This is simpler and keeps you in full control of your assets, making it a convenient option for users who want a clean, all-in-one experience. You still benefit from Polkadot’s security and decentralization, and you can choose between pools or solo staking. However, wallet-based staking may not always give you as many advanced controls or analytics as the dashboard.

Third-party decentralized protocols

Certain DeFi platforms offer staking services with added features like liquid staking tokens, flexible unbonding, or the ability to use your staked DOT in other DeFi applications. These can be appealing if you want more liquidity or the option to stake smaller amounts. On the downside, you introduce additional risks from third-party smart contracts and partially give up custody of your assets. Some large pools can also impact decentralization, so it’s worth doing your own research before choosing this route.

Custodial exchanges

Many centralized exchanges offer DOT staking as a simple, one-click service. This can be the easiest way to get started, but it comes with the highest trust requirements since the exchange controls your assets. Returns may be lower, unbonding terms stricter, and in some cases, large exchange pools can harm network decentralization. If you value convenience over control, this may be an option, but it’s less ideal for long-term network health.

How to stake directly in your wallet

If you prefer to keep everything in one place, you can stake DOT right inside your wallet. The process is straightforward and varies slightly by wallet:

Talisman

- Open the Talisman extension, then select Staking in the menu.

- On the staking dashboard, choose DOT.

- In the staking drawer, pick your account, confirm DOT as the asset, and select a nomination pool.

- Enter the amount to stake, click Stake, then confirm the transaction in the wallet pop-up.

- Manage your position under Positions: increase stake, unstake, adjust claim settings, and view statistics.

Notes: Talisman integrates Polkadot’s native nomination pools. Your assets remain in your control, and you can access your pool from other frontends if needed. Unbonding periods still apply.

View the full Talisman staking guide for more information.

Nova Wallet

- Open Nova Wallet and make sure the network is set to Polkadot.

- Tap Staking on the home screen.

- Tap Start staking (or Join pool) and choose Nomination pools.

- Browse pools, review basic details, then select the pool you want to join.

- Enter the amount of DOT to stake, choose your rewards destination (compound or free balance), and continue.

- Confirm the transaction in-app.

- Track your position in Staking → Your pool. From here, you can add more, start unbonding, and withdraw after the 28-day unbonding period.

View the full Nova Wallet staking guide for more information.

SubWallet

- Open SubWallet (browser extension or mobile app) and go to Earning.

- Select DOT from the list of supported assets.

- Choose your staking type

- Nomination pools: Polkadot’s native, fully onchain staking. You keep full control of your tokens, earn rewards, and help secure the network. Fixed 28-day unbonding on Polkadot.

- Liquid staking: Third-party option (e.g., Bifrost) that gives you a tradable token like vDOT to use in DeFi while earning rewards. May unbond faster, but adds smart contract and protocol risks.

- Enter your staking amount

- Review and confirm

- For liquid staking, read the provider details, then tap Stake to earn. Approve the transaction when prompted.

- Track your staking

- Return to the Earning tab to monitor your positions and manage rewards or unbonding.

View the full SubWallet staking guide for more information.

Ledger Live

- Open Ledger Live and make sure your Ledger device is connected and up to date.

- Add a Polkadot (DOT) account in Ledger Live if you haven’t already.

- Go to your DOT account and click Earn. This opens the Yield.xyz app inside Ledger Live.

- Enter the amount of DOT you want to bond, then review the validator options. You can click the + button to select additional validators.

- Confirm the bonding transaction (lock) on your Ledger device.

- Sign the nominating transaction (vote) on your Ledger device to start earning rewards.

- Track your position under your Polkadot account in Ledger Live. Rewards typically start appearing after 2–3 days.

Notes: Your bonded DOT will remain locked until you unbond, which takes 28 days to complete. Always choose validators carefully to avoid oversubscribed or high-commission ones.

View the full Ledger Live staking guide for more information.

How to stake with the Polkadot Staking Dashboard

The Polkadot Staking Dashboard makes it easy to stake DOT directly from your browser while giving you full control over your staking setup. Here’s how to get started.

1. Set up a compatible wallet

Install and set up a supported wallet such as Talisman, SubWallet, or Nova Wallet. Make sure you securely store your seed phrase offline before connecting.

2. Connect your wallet to the dashboard

Visit the official Polkadot Staking Dashboard and verify the URL to ensure you’re on the correct site. Connect your wallet using the prompts in your browser or mobile app.

3. Choose your staking method

You can stake DOT in two ways:

- Nomination pool: Stake with a low DOT minimum and let the pool handle validator selection. Rewards are distributed automatically.

- Solo staking: Stake a higher amount and select your own validators for more control.

4. Select validators or a pool

If you are solo staking, review validator performance, commission rates, and reliability before making your choice. For pools, browse the list and pick one that fits your needs.

5. Confirm and start staking

Enter the amount of DOT you want to bond and confirm the transaction in your wallet. Your stake is now live onchain. You can track rewards, nomination status, and other details directly in the Staking Dashboard.

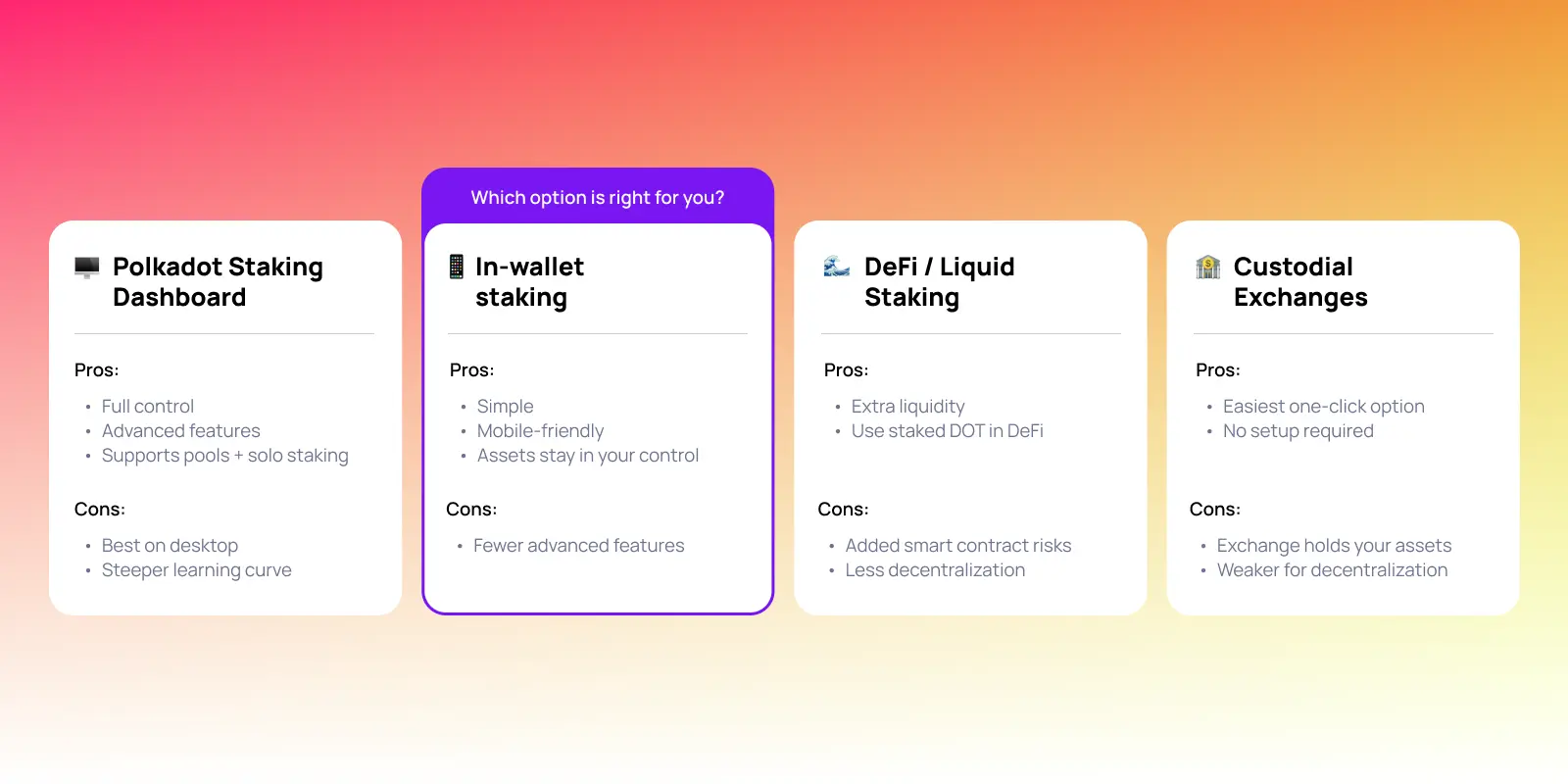

Dashboard or in-wallet staking: which should you choose?

Both options let you stake DOT securely, but the right choice depends on your needs.

- Ease of use: Wallet staking is generally simpler and more beginner-friendly, especially for quick setup on mobile. The Staking Dashboard offers a bit more complexity but gives you full visibility and control over your positions.

- Feature set: The Staking Dashboard supports advanced features like batch payouts and nominating multiple validators at once. Wallet staking focuses on core staking flows, with some wallets adding convenience tools like reward notifications.

- Accessibility: Wallet staking works seamlessly on mobile, making it ideal for on-the-go management. The Dashboard is best experienced on desktop for easier navigation and advanced actions.

If you’re just starting out or prefer mobile, in-wallet staking might be the smoother path. If you want granular control over your staking strategy, the Dashboard is worth the extra learning curve.

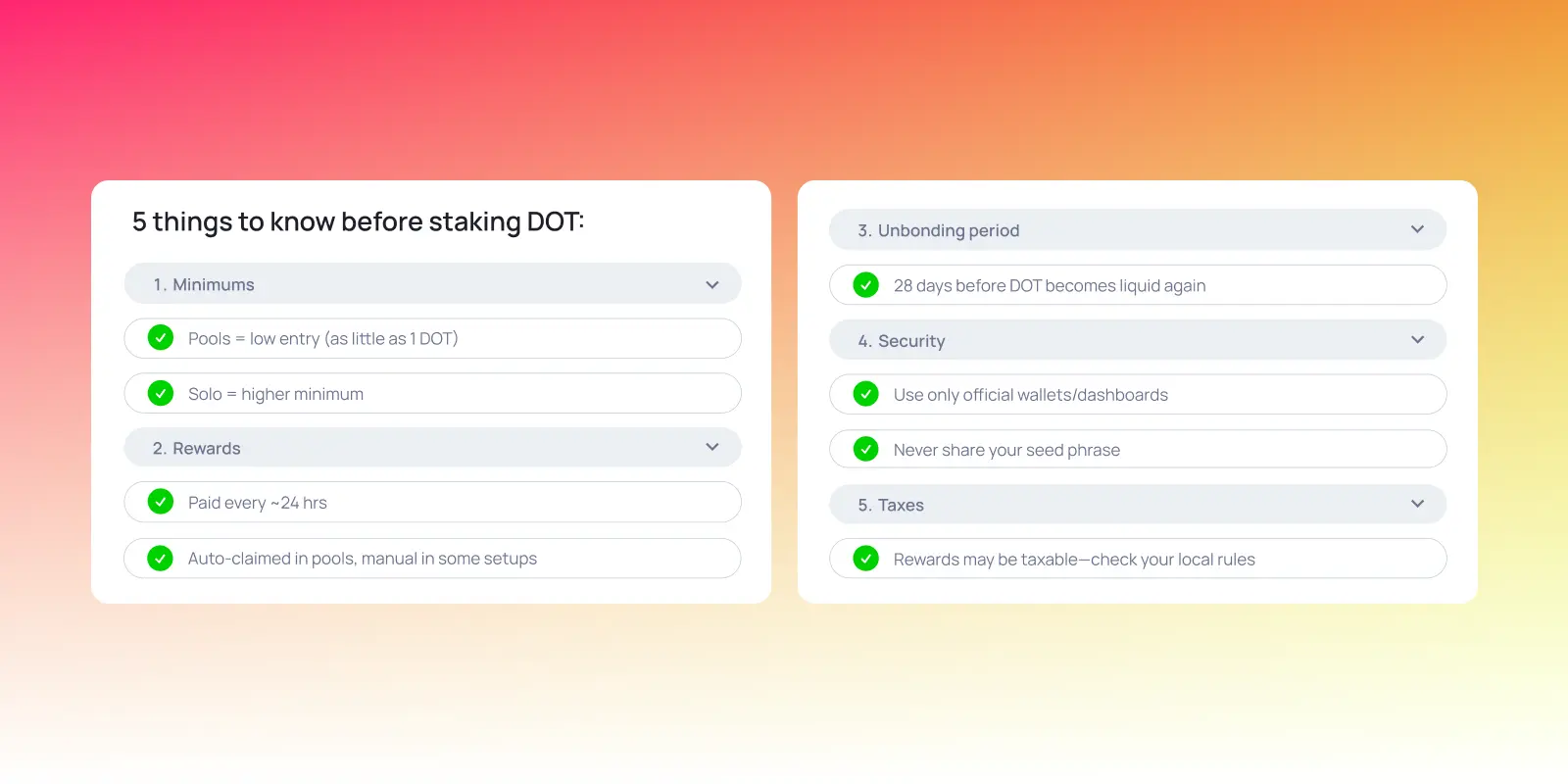

Read this before you stake your first DOT

Before you stake, keep these points in mind:

- Minimum requirements: Nomination pools have a low entry requirement (currently as little as 1 DOT on Polkadot), while solo staking requires a higher minimum and active validator selection.

- Unbonding period: When you unstake, your tokens remain locked for a set time (currently 28 days on Polkadot) before becoming liquid again.

- Rewards: Staking rewards are typically distributed every era (about 24 hours). Depending on your method, you may need to claim them manually or they may be auto-claimed.

- Security: Always stake from a wallet you control and never share your seed phrase. Use official apps, extensions, or dashboards.

- Taxes: In some jurisdictions, staking rewards may be considered taxable income—check local regulations.

The bottom line

Both dashboard and in-wallet staking are secure, reliable ways to earn while supporting the Polkadot network. Choose the method that fits your needs and start staking today.

Start staking now to grow your DOT and strengthen Polkadot’s future.