Real World Assets on Polkadot: Your comprehensive guide to RWA

Real-World Assets bring physical value onto blockchain. Learn what RWAs are, how tokenization works, and why Polkadot is best for RWA projects.

By Joey Prebys•October 21, 2025

By Joey Prebys•October 21, 2025

What you can expect

- What RWAs are and why tokenization matters

- How tokenization works: mechanics and infrastructure

- The benefits of RWA tokenization

- How RWAs are changing DeFi

- Real-world asset projects building on Polkadot

- Why builders choose Polkadot for RWA tokenization

Blockchain technology finally has a real-world use case, and it's not another memecoin. Real-World Assets (RWAs) are tokenizing the physical economy: buildings, gold, energy credits, you name it. If it has value in the real world, someone's figuring out how to put it on a blockchain.

The implications go way beyond better portfolio diversification. We're talking about dismantling the gatekeeping that's kept everyday investors out of the most lucrative asset classes for decades. The RWA tokenization market reached $24 billion in June 2025, up 380% in three years. McKinsey projects the RWA market size will reach $2 trillion by 2030, while Boston Consulting Group estimates tokenized assets could represent 10% of global GDP by 2030.

These projections signal rapid convergence between traditional finance and the decentralized economy.

This guide breaks down what RWAs are, how tokenization works, and why Polkadot is the go-to platform for projects bringing real-world value on-chain.

What are Real-World Assets (RWAs) and tokenization?

Real-World Assets (RWAs) are what you get when you take traditional assets and tokenize them on a blockchain. Take a building, turn its value into digital tokens, and suddenly that real estate can be bought and sold like any other crypto asset. The same goes for gold, company shares, renewable energy credits, music rights, and more.

Each token represents a verifiable, divisible, transferable claim of ownership over the underlying asset. If you own some of those tokens, you own a portion of that building. It's that straightforward.

The growing significance of tokenized assets in the digital economy

Early blockchain projects were all about creating new digital currencies. RWAs flip that script by bringing the traditional economy onto the blockchain. For investors, this opens access to asset classes that were previously out of reach. For asset owners, it unlocks liquidity from traditionally illiquid investments like real estate or private equity.

The momentum is real: 71% of global asset managers plan to integrate tokenized assets into portfolios within five years. We're watching traditional financial markets get rewired in real time, with more efficient asset management and entirely new market opportunities emerging across every major asset class.

Why tokenize Real-World Assets?

Traditional asset ownership is not efficient. Your real estate deed sits in a filing cabinet. Selling takes weeks of paperwork and hefty fees. Selling just 10% of it? This is impossible.

Tokenization moves ownership records from paper deeds and outdated registries onto a blockchain. Once an asset is onchain, its ownership and transaction history live on an immutable, transparent ledger.

This isn't just digitizing paperwork—it fundamentally changes what you can do with the asset. That building can be divided into 10,000 pieces and traded 24/7. Renewable energy credits get verified instantly. Music rights distribute royalties automatically through smart contracts. The technology transforms how assets are owned, traded, and managed.

Tokenization is happening everywhere. Companies raise money faster. Real estate developers offer fractional ownership worldwide. Farmers finance their work through tokenized crops. Artists earn royalties directly without middlemen.

What types of real-world assets can be tokenized?

Pretty much anything with value. RWAs fall into two categories:

- Tangible assets: Physical objects like real estate (commercial buildings, homes), commodities (gold, oil, agricultural products), renewable energy assets (solar panels, wind farms), machinery, vehicles, and fine art.

- Intangible assets: Non-physical but valuable financial assets like company shares, government and corporate bonds, private credit, intellectual property (patents, copyrights), carbon credits, and music royalties.

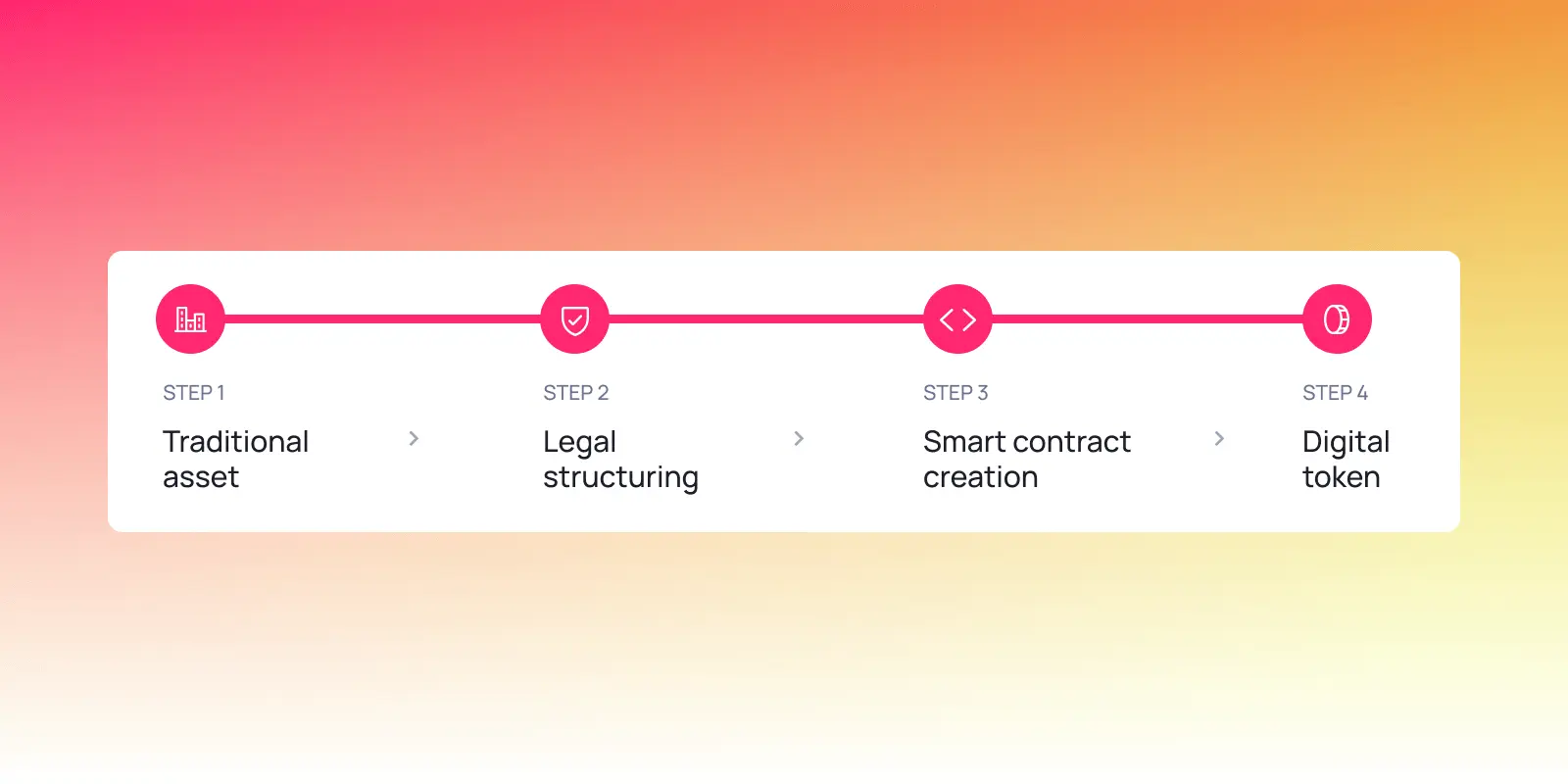

How tokenization works: turning assets into digital tokens

Asset tokenization converts ownership rights into digital tokens with blockchain technology. Each token acts as a digital certificate linked directly to the underlying asset.

Simple example: Take a $1 million building, split it into one million tokens, and each token represents 0.0001% ownership. Buy 1,000 tokens? You own 0.1% of that building.

Why blockchain is the foundation

Blockchain technology makes tokenization possible through a distributed ledger with four critical features:

- Immutability: Transactions can't be altered or deleted, creating tamper-proof ownership records.

- Transparency: All transactions are visible to participants, providing unprecedented auditability.

- Decentralization: The ledger runs across multiple computers, eliminating single points of failure.

- Security: Cryptographic principles secure transactions and control token creation.

Polkadot takes this further with shared security. Projects building on Polkadot get enterprise-grade protection automatically, without the cost and complexity of maintaining their own validator sets. This means projects can focus on their application logic while inheriting security from the network.

What makes up a tokenized asset

A tokenized real-world asset is more than a digital file—it's a package of technology and legal frameworks:

- The underlying asset: The real-world item (real estate, gold, music rights, energy certificate).

- The smart contract: Self-executing code that automates payments, enforces rules, and manages rights. Smart contracts eliminate the need for intermediaries by executing predetermined conditions automatically.

- The digital tokens: Units of ownership representing claims on the underlying asset.

- Token standards: Protocols ensuring compatibility across blockchain networks for seamless ownership transfer.

- Custody solutions: Secure storage systems for both digital tokens and their underlying off-chain assets.

The benefits of RWA tokenization

Tokenization unlocks strong benefits. It fixes long-standing problems in traditional asset markets.

- Enhanced liquidity: Converts illiquid assets into tradable digital tokens available 24/7 on global secondary markets.

- Fractional ownership: Smart contracts divide high-value assets into thousands of tokens, enabling $100 investments instead of hundreds of thousands.

- Trustless verification: Blockchain eliminates the need to trust intermediaries for ownership verification. Smart contracts execute automatically based on code rather than human discretion, and anyone can independently verify ownership records and transaction history without relying on centralized authorities like title companies, custodians, or registries.

- Operational efficiency: Smart contracts automate payments, compliance, record-keeping, and asset management, eliminating intermediaries.

- Transparency: Immutable blockchain ledger creates auditable trails that reduce fraud.

- Global access: Borderless blockchain networks enable worldwide participation and DeFi integration for lending and collateralization.

- Faster settlements: Transactions complete in seconds rather than days or weeks.

How RWAs are changing Decentralized Finance (DeFi)

DeFi has been powerful but limited by volatile crypto assets. RWA tokenization changes that by letting trillions of dollars from traditional financial markets and capital markets flow into decentralized finance, creating a more stable and diverse financial system.

The best example? Stablecoins. These are actually RWAs in themselves, digital tokens pegged to offchain assets like the U.S. dollar. They've become the most successful form of RWA tokenization to date, providing the stable foundation that DeFi protocols need to function.

Building DeFi platforms for tokenized assets

Investment platforms handling tokenized real-world asset products face a tricky balance: meeting regulatory compliance requirements while keeping DeFi's efficiency. Getting this right requires robust infrastructure.

These platforms need secure storage through custody solutions, ownership transfer mechanisms, and active secondary market liquidity where tokenized assets can be traded. The technology must handle automated payments through smart contracts, compliance checks, and token standards that work across different systems—creating asset management systems that serve everyone from big institutions to individual investors.

Projects building on Polkadot are demonstrating how to pull this off at scale, which we'll dig into below.

The DeFi integration opportunity

Here's where it gets interesting: using RWAs as collateral for loans within DeFi ecosystems.

Businesses can turn financial assets into collateral for financing, tapping into global liquidity. Deposit tokens representing rental property and borrow stablecoins against them. Use tokenized government bonds as collateral for working capital. This creates new ways to access credit and earn yields, combining real-world stability with DeFi's flexibility.

Real-world assets on Polkadot: What's being built

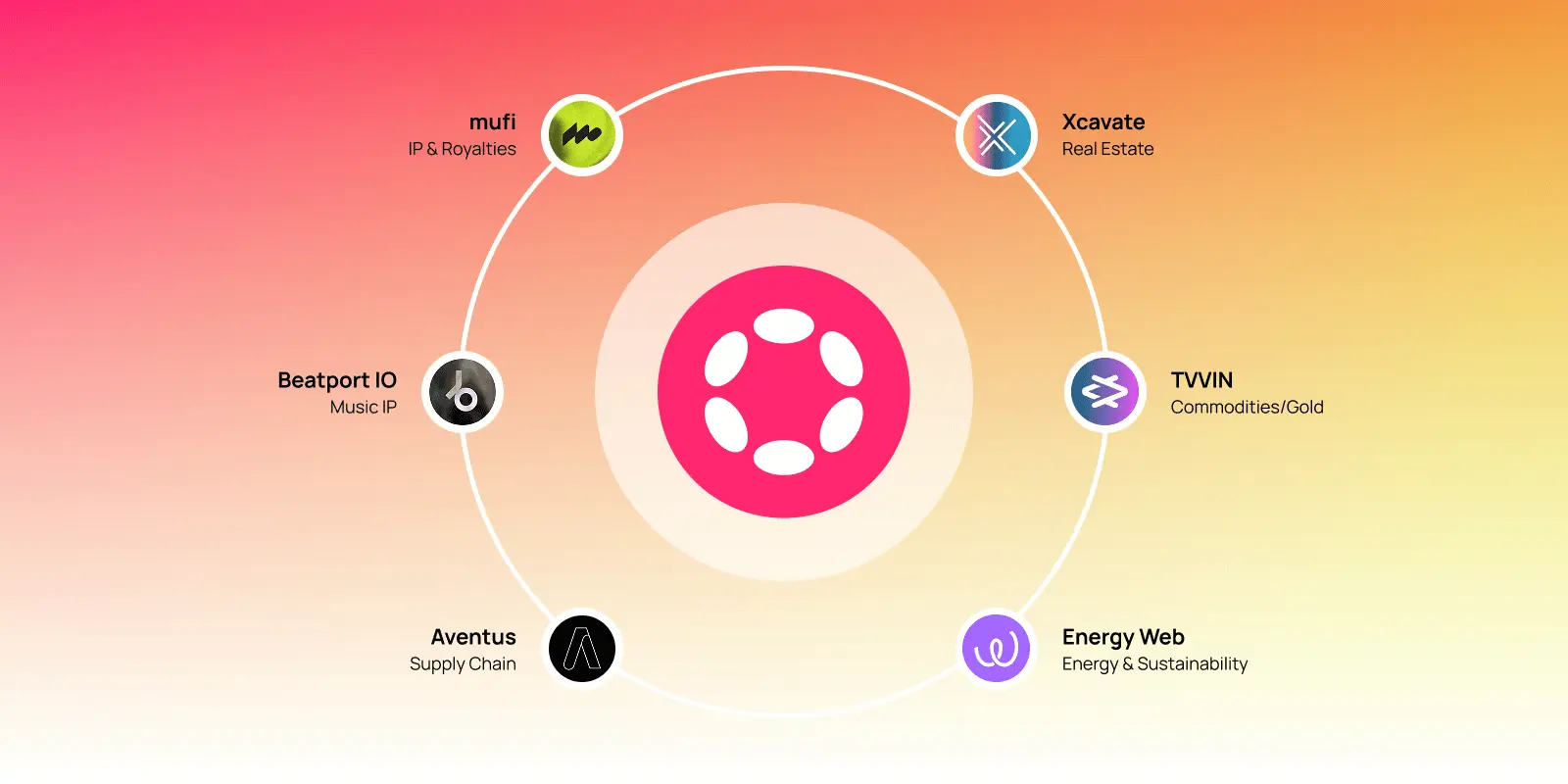

Projects on Polkadot are tokenizing assets across every major category, proving RWA tokenization works at scale.

Real estate

Xcavate tokenizes individual properties and removes intermediaries, opening the $378.7 trillion global real estate market to everyday investors. Fractional ownership lowers entry barriers dramatically, and the platform automates key processes through smart contracts.

Commodities

TVVIN offers tokenized gold backed 1:1 by LBMA-certified gold securely vaulted in the Channel Islands. The platform provides custody solutions through financially regulated partners, transparent audits, and Polkadot-based trading infrastructure.

Energy and sustainability

Energy Web uses Polkadot’s shared security to deliver enterprise-grade Web3 solutions for global decarbonization. From sustainable fuels to real-time verified compute, Energy Web is redefining trust in energy markets.

Their Sustainable Aviation Fuel Registry (SAFc) verifies every transaction of low-carbon aviation fuel for major partners such as United Airlines and Amazon, ensuring full traceability and compliance across the value chain.

In the maritime sector, Energy Web's Katalist enables transparent tracking and verification of sustainable marine fuels, used by leading corporates and catalysts driving decarbonization at sea.

“Polkadot provides the underlying shared security, enabling Energy Web to deploy enterprise-grade Web3 applications faster, safer, and at a scale not possible on traditional networks.” says CEO EWF Ed Hesse.

Intellectual property and royalties

Projects like mufi build embedded wallets and loyalty systems for live events, automating royalty distribution for artists. Beatport IO creates browser-based remix tools that track music creation onchain. These platforms enable artists to receive direct royalties automatically, cutting payment wait times by over 90%, transforming how the music industry works, and creating real success stories for artists and builders.

Supply chain and logistics

While most RWA tokenization focuses on financial assets, Aventus demonstrates how blockchain can tokenize supply chain data and operational workflows—creating immutable, verifiable records of real-world goods as they move through the system.

At Heathrow Airport, Aventus' partnership with Airport Perishables Handling tokenizes cargo tracking data, creating a single source of truth across stakeholders. This achieved an 83% reduction in manual documentation and decreased cargo transport time from 4 hours to 30 minutes. By putting supply chain records on-chain, Aventus creates tokenized provenance and tracking credentials that have real operational and financial value.

Why builders choose Polkadot for RWA tokenization

Polkadot's architecture solves the critical challenges that have held back RWA adoption on other platforms.

- Speed and scalability: Polkadot's modular architecture supports parallel transaction processing while Elastic Scaling allocates resources dynamically. When volume spikes, the system scales without degrading performance or inflating costs.

- Ironclad security: Shared security provides institutional-grade protection from day one. As former Energy Web CEO Jesse Morris explains, enterprise applications take cybersecurity seriously, and Polkadot's shared security serves as another insurance policy for their applications. Projects inherit this protection automatically, avoiding the costs and headaches of building it from scratch.

- Custom solutions: Polkadot SDK streamlines development while enabling precise customization. Tracking sustainable aviation fuel requires different workflows than managing real estate tokens—Polkadot's modularity handles both without sacrificing speed or security.

- Advanced asset management: Polkadot's infrastructure enables projects to build automated dividend distribution, compliance modules, and custody solutions for institutional-level operations across asset classes.

- Enterprise-ready infrastructure: Oracles integrate with Polkadot to verify asset values and enable cross-chain connectivity, positioning it as the infrastructure layer bridging the Web3 ecosystem and traditional finance.

Challenges and critical considerations

- Regulatory frameworks and compliance: Regulatory considerations and clarity remain the biggest challenge as jurisdictions vary in their approach. Polkadot SDK includes compliance-ready modules, and projects like Energy Web work directly with regulators to establish infrastructure standards.

- Legal ownership: Token ownership must translate to legal ownership through careful structuring using dedicated legal entities and qualified custodians. Smart contracts must align with legal agreements for enforceability.

- Technical security: RWA platforms must integrate with existing financial infrastructure while maintaining security. Polkadot's shared security model allows projects to inherit protection from the Polkadot Chain.

- Market liquidity: Tokenization creates the potential for liquidity, but actual market liquidity depends on sufficient participation. Infrastructure must handle growing trading volume without performance issues or cost increases.

- Data integrity: Accurate tokenized real-world asset valuation requires reliable offchain data feeds for effective asset management. Polkadot's architecture supports oracle integration for verified real-world data on asset pricing and performance.

The future of real-world asset tokenization

The projections are ambitious, but real progress is happening today. Energy Web partners with over 100 major energy companies. Xcavate is opening the multi-trillion-dollar real estate market. TVVIN offers tokenized commodities that meet institutional standards. The infrastructure is here, regulations are evolving, and institutional adoption is accelerating.

Key trends accelerating tokenized asset adoption

- Regulatory clarity: As global rules improve, compliant tokenization will accelerate. Polkadot's compliance-ready tools and projects like Energy Web working directly with regulators position the ecosystem to adapt quickly.

- Institutional integration: Major brands like United Airlines, Amazon, Shell, and PayPal use Polkadot-based blockchain infrastructure through Energy Web for real business operations.

- DeFi convergence: Integrating RWAs into DeFi protocols unlocks new financial products, from asset-backed lending to yield strategies combining traditional and crypto returns.

- Sustainability innovation: Tokenization of renewable energy assets, carbon credits, and sustainability certificates is creating new markets. Energy Web's expansion from Australia to the UK, Costa Rica, and the United States demonstrates global scalability.

The future is tokenized

Real-world asset tokenization is dismantling the barriers that kept everyday investors out of trillion-dollar asset classes. Projects on Polkadot show it works at scale. Xcavate is opening the $378.7 trillion real estate market. TVVIN offers institutional-grade tokenized gold. Energy Web supports sustainability solutions for United Airlines, Amazon, Shell, and PayPal.

The infrastructure is here. The technology works. And the convergence of physical and digital value is creating a more efficient, transparent, and inclusive financial future.

Ready to explore real-world assets on Polkadot? Explore tokenized assets, build next-generation infrastructure, or bring your own assets on-chain.