DEX vs CEX: A beginner's guide to crypto exchanges

Centralized and decentralized exchanges offer different paths into crypto. This beginner-friendly guide breaks down how they work, why DEXs matter for financial access, and how Polkadot supports a more open, permissionless future for global users.

By Joey Prebys•April 9, 2025

By Joey Prebys•April 9, 2025

What you can expect

- What a centralized exchange is and how it works

- How decentralized exchanges are different

- Explore how DEXs like Hydration and StellaSwap bring DeFi to Polkadot

- Key differences between CEXs and DEXs

- Why DEXs matter for financial access

- How Polkadot supports a decentralized future

Decentralized finance, or DeFi, is a movement to rebuild financial tools and services using open, programmable infrastructure. It replaces traditional intermediaries—like banks and brokers—with smart contracts and decentralized protocols. With just a crypto wallet, anyone can access tools for trading, lending, borrowing, saving, and more—without permission or centralized control.

Exchanges play a foundational role in this system. Some are centralized and function more like traditional financial institutions. Others are decentralized and run entirely on smart contracts. Understanding how each one works is essential for anyone exploring DeFi.

But this is not just about how technology works. The rise of decentralized exchanges points to a broader shift—from centralized gatekeeping to open, permissionless access. It’s about financial empowerment, individual privacy, and creating systems that anyone can use—regardless of where they live or what documents they have.

What is a centralized exchange (CEX)?

A centralized exchange is a cryptocurrency trading platform run by a company or organization that acts as the go-between for buyers and sellers. Think Coinbase, Kraken, or Binance. These platforms let you buy and sell crypto using US Dollars and other fiat currency, and you can also trade between coins and tokens directly on the platform.

How does a CEX work?

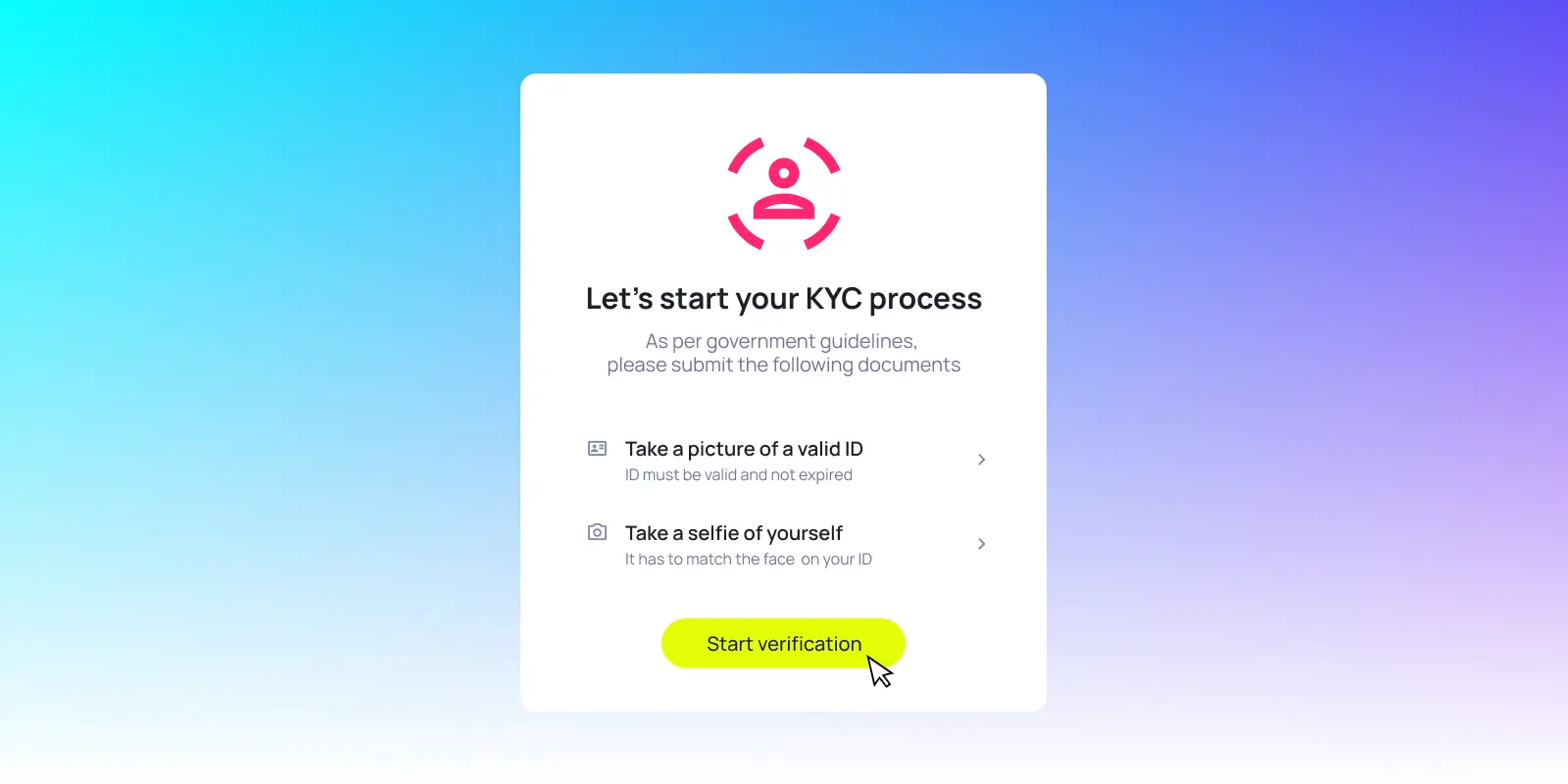

To use a centralized exchange, you start by creating an account and verifying your identity with a government ID and proof of address. Then, you can deposit fiat using a linked bank account or card. From there, you can buy or trade crypto using the platform’s dashboard.

The exchange holds your assets in a custodial wallet and matches your trades through its internal system. If you want to withdraw, you can either send crypto to your own wallet or convert it back to fiat and cash out. Just keep in mind that most CEXs have withdrawal fees and limits.

Upsides to using a CEX

- Easy to use: The interfaces feel familiar. You can link your bank account or card and buy crypto without needing to know anything about wallets or gas fees. If you get stuck, there is usually a customer support team to help you out. Just keep in mind that real support will never reach out to you first or offer help over social media.

- High liquidity and fast execution: CEXs have large user bases and fast trading engines, so trades are quick, and prices stay stable most of the time.

- Regulatory compliance: These platforms are regulated in the countries in which they operate, which may give some people peace of mind.

Downsides to using a CEX

- Not your keys, not your wallet: This is the big one. You are trusting someone else to hold your crypto. If the exchange gets hacked or collapses, your funds could be gone. We have seen this happen before. FTX did not just shut down. It took people’s assets with it.

- Downtime during volatility: When the market is moving fast, centralized exchanges can crash. You might get locked out right when you are trying to trade, which means missing out on the best price or timing.

- Privacy trade-offs: Because of KYC (know your customer) and AML (anti-money laundering) rules, you have to share personal information like your ID, proof of address, and maybe even a selfie. That does not sit well with everyone, especially if you came to crypto for privacy.

- Limited accessibility: CEXs often require a bank account, government documents, and a clean financial record. If you live in a sanctioned country or face political instability, you might be blocked entirely. These platforms can help people get started with crypto, but they are not built for everyone. That leaves out the people who may need it most.

What is a decentralized exchange (DEX)?

A decentralized exchange is a crypto trading platform that connects buyers and sellers directly through smart contracts. There is no middleman. You trade right from your wallet, not through a company. That is a major shift from how centralized exchanges work.

Some well-known DEXs include Uniswap, Curve, Aerodome, and Hydration. These platforms live onchain and let you swap tokens peer-to-peer using automated tools like liquidity pools and pricing algorithms.

How does a DEX work?

When you trade on a DEX, you’re interacting with a smart contract, not a company. Here’s what’s actually happening under the hood:

- You connect your wallet. There is no login or account required. Then, you approve the trade directly. That action triggers the smart contract.

- The smart contract does the rest. It calculates the price using an automated market maker (AMM), which is a smart contract that adjusts the price based on how much of each token is in the liquidity pool.

- Liquidity pools make it possible. These are collections of token pairs provided by other users. When you make a swap, you are trading directly against that pool, not with another person. For example, Hydration has a DOT /USDC pool, which means you can easily swap between those tokens without needing a seller on the other side.

- No orderbook, no middleman. The trade settles onchain. You get your tokens, and the liquidity pool updates automatically.

Everything happens transparently and without a central authority. You keep control of your keys the entire time.

Upsides to using a DEX

- You hold your own keys: There is no custodial setup. You trade directly from your non-custodial wallet, which means you are always in control of your assets. No one can freeze your funds or shut down your account.

- Open access from anywhere: All you need is a wallet. You do not need to upload an ID or have a bank account. That makes DEXs one of the few options available to people who have been left out of the traditional system.

- Censorship resistance: Because DEXs are powered by smart contracts and not centralized infrastructure, they are much harder to censor or shut down. As long as the network exists, the exchange continues to work. This is Web3 as public infrastructure.

Downsides to using a DEX

- The learning curve is steeper: DEXs give you more control, but they take some getting used to. You need to manage your own wallet, pay transaction fees, verify token contracts through trusted sources like the project’s site or data platforms like CoinGecko or CoinMarketCap, and understand concepts like slippage and how to read a block explorer if something goes wrong.

- The user experience still needs work: Wallets disconnect and transactions fail. The tech is getting better, but it is not as smooth as a centralized platform. Centralized exchanges usually have safeguards in place to protect your funds when something goes wrong. On a DEX, you're often on your own.

- You need crypto to use a DEX: Most DEXs don’t support fiat currency. You can’t connect your bank account or card and buy tokens directly. To trade on a DEX, you need to already have crypto in your wallet. For most people, that means using a centralized exchange or a fiat onramp first before bridging into the world of decentralized finance.

DEXs on Polkadot

These platforms let you trade tokens, earn rewards, and explore DeFi while staying fully in control of your assets.

- Hydration: Best for trading a wide variety of tokens efficiently. It is ideal for larger trades or busy market moments, with a system designed to keep price changes minimal.

- StellaSwap: StellaSwap is great for users familiar with MetaMask or Ethereum-based tools. It offers token swaps, yield farming, and a clean, beginner-friendly experience.

To use Hydration or StellaSwap, you will need a Polkadot-compatible wallet such as Nova, Talisman, or SubWallet. These wallets connect directly to the exchange so you can trade, provide liquidity, and explore DeFi tools while staying in control of your assets.

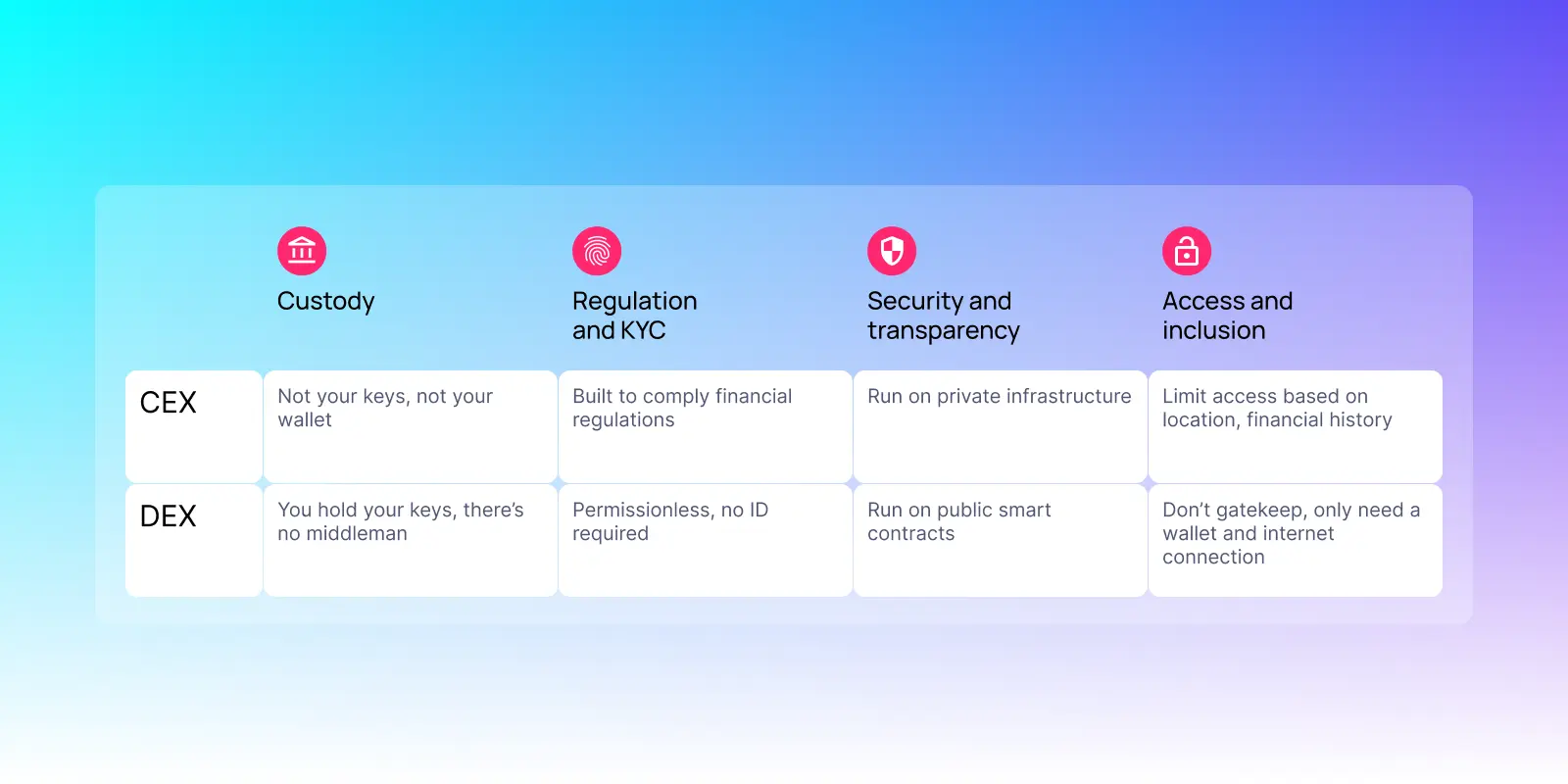

CEX vs. DEX: Key differences

While both CEXs and DEXs let you trade crypto, they do it in fundamentally different ways. From how assets are stored to who gets access, the two models reflect opposite ends of the spectrum when it comes to control, trust, and openness.

- Custody: When you use a centralized exchange, the platform holds your keys and controls your funds. On a DEX, you hold your keys and trade directly from your own wallet. There is no middleman.

- Regulation and KYC: CEXs are built to comply with financial regulations. That means going through identity checks and getting account approval. DEXs are permissionless. Anyone with a wallet can use them—no ID required.

- Security and transparency: CEXs run on private infrastructure. You do not always know what is happening behind the scenes. DEXs run on public smart contracts, where transactions and logic are visible onchain.

- Access and inclusion: CEXs often limit access based on location, documentation, or financial history. DEXs do not have gatekeepers. If you have a wallet and an internet connection, you can trade.

DEXs and the future of a fairer financial system

Decentralization isn’t just technical. It’s about reducing our reliance on institutions that decide who gets access and who does not. In a centralized system, your options are shaped by where you live, what documents you have, and which banks will work with you.

DEXs are different. There are no gatekeepers. All you need is a wallet and internet access. For people in unstable or restricted environments, this can be a lifeline. In places like Venezuela, Nigeria, and Ukraine, crypto has helped people protect their savings, access stable assets, and move money without fear of censorship.

This is what Web3 is meant to be: open tools, available to anyone. With a DEX, you hold your own keys, control your assets, and decide your path. That’s not just a better experience—it’s a more fair and resilient system.

DEXs in action: expanding access to global finance

- Uniswap in Nigeria: During the 2020 protests in Nigeria, authorities froze the bank accounts of activist groups. In response, organizers turned to crypto. Some used Uniswap to convert donations without relying on banks. The government could not block the transactions.

- Ukrainians using DEXs during the invasion: During the early days of the war in Ukraine, many turned to DEXs and self-custodied wallets to protect assets and move money when centralized platforms were restricted or offline.

Building an open financial system with Polkadot

Centralized and decentralized exchanges both play an important role in crypto today. Centralized platforms offer ease of use and accessibility for newcomers. But it is decentralized exchanges that reflect the core values of Web3—openness, transparency, peer-to-peer trading, and individual ownership.

Polkadot strengthens the foundation for this decentralized future by supporting fast, secure cross-chain activity and shared security across its ecosystem. These features power DEXs that are flexible, scalable, and truly permissionless—built to put ownership back where it belongs: with the user.

Ready to explore DeFi on Polkadot? Start by choosing a wallet that gives you full control of your assets. Browse wallets that support self-custody and connect to dapps across the network.